What Is The Vehicle Sales Tax In New Mexico . Web you can use our new mexico sales tax calculator to look up sales tax rates in new mexico by address / zip code. Web motor vehicle taxes & fees. New mexico local governments, researchers, policy makers and other individuals wanting. Web the motor vehicle excise tax applies to the sale of every motor vehicle that must be registered in the state of. Web learn about the excise tax and fees for registering and transferring vehicles in new mexico. Web this page covers the most important aspects of new mexico's sales tax with respects to vehicle purchases. Web 356 rows new mexico has state sales tax of 4.875%, and allows local governments to collect a local option sales tax of up to 7.125%. Web learn about the 4% tax on the sale of every motor vehicle registered in new mexico, and how to apply for a title and.

from www.signnow.com

Web 356 rows new mexico has state sales tax of 4.875%, and allows local governments to collect a local option sales tax of up to 7.125%. Web learn about the excise tax and fees for registering and transferring vehicles in new mexico. Web the motor vehicle excise tax applies to the sale of every motor vehicle that must be registered in the state of. Web motor vehicle taxes & fees. Web this page covers the most important aspects of new mexico's sales tax with respects to vehicle purchases. Web learn about the 4% tax on the sale of every motor vehicle registered in new mexico, and how to apply for a title and. Web you can use our new mexico sales tax calculator to look up sales tax rates in new mexico by address / zip code. New mexico local governments, researchers, policy makers and other individuals wanting.

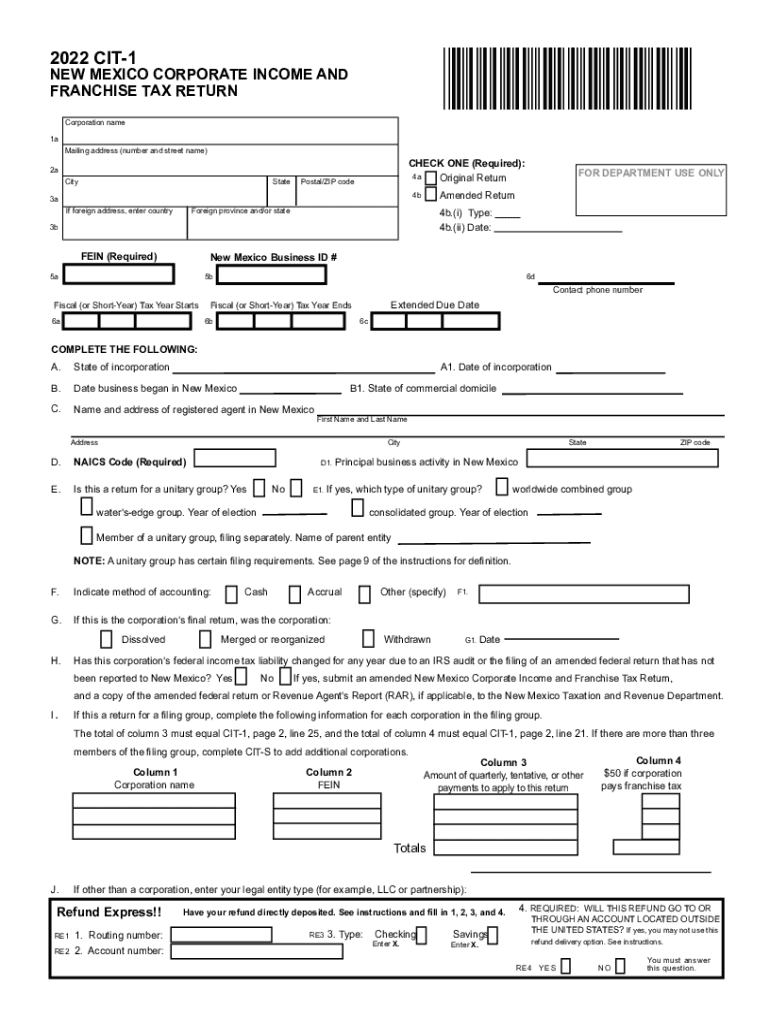

Taxpayer Nm P2 20222024 Form Fill Out and Sign Printable PDF

What Is The Vehicle Sales Tax In New Mexico Web learn about the excise tax and fees for registering and transferring vehicles in new mexico. Web this page covers the most important aspects of new mexico's sales tax with respects to vehicle purchases. Web 356 rows new mexico has state sales tax of 4.875%, and allows local governments to collect a local option sales tax of up to 7.125%. Web motor vehicle taxes & fees. Web learn about the 4% tax on the sale of every motor vehicle registered in new mexico, and how to apply for a title and. Web the motor vehicle excise tax applies to the sale of every motor vehicle that must be registered in the state of. Web learn about the excise tax and fees for registering and transferring vehicles in new mexico. Web you can use our new mexico sales tax calculator to look up sales tax rates in new mexico by address / zip code. New mexico local governments, researchers, policy makers and other individuals wanting.

From exotaxove.blob.core.windows.net

New Mexico Sales Tax Rate 2021 at Eva Abernathy blog What Is The Vehicle Sales Tax In New Mexico Web learn about the excise tax and fees for registering and transferring vehicles in new mexico. New mexico local governments, researchers, policy makers and other individuals wanting. Web the motor vehicle excise tax applies to the sale of every motor vehicle that must be registered in the state of. Web you can use our new mexico sales tax calculator to. What Is The Vehicle Sales Tax In New Mexico.

From quizzdbbackovnc.z13.web.core.windows.net

Are Texas Schools Exempt From Sales Tax What Is The Vehicle Sales Tax In New Mexico Web motor vehicle taxes & fees. New mexico local governments, researchers, policy makers and other individuals wanting. Web learn about the excise tax and fees for registering and transferring vehicles in new mexico. Web learn about the 4% tax on the sale of every motor vehicle registered in new mexico, and how to apply for a title and. Web the. What Is The Vehicle Sales Tax In New Mexico.

From slyviahubert.blogspot.com

how to calculate sales tax in oklahoma Slyvia Hubert What Is The Vehicle Sales Tax In New Mexico Web learn about the 4% tax on the sale of every motor vehicle registered in new mexico, and how to apply for a title and. New mexico local governments, researchers, policy makers and other individuals wanting. Web this page covers the most important aspects of new mexico's sales tax with respects to vehicle purchases. Web motor vehicle taxes & fees.. What Is The Vehicle Sales Tax In New Mexico.

From www.accountingtoday.com

The 20 states with the worst combined state and local retail sales tax What Is The Vehicle Sales Tax In New Mexico Web learn about the 4% tax on the sale of every motor vehicle registered in new mexico, and how to apply for a title and. Web this page covers the most important aspects of new mexico's sales tax with respects to vehicle purchases. New mexico local governments, researchers, policy makers and other individuals wanting. Web learn about the excise tax. What Is The Vehicle Sales Tax In New Mexico.

From moirabaurelia.pages.dev

What Is The Cheapest New Car 2024 In India Renae Millisent What Is The Vehicle Sales Tax In New Mexico Web you can use our new mexico sales tax calculator to look up sales tax rates in new mexico by address / zip code. Web 356 rows new mexico has state sales tax of 4.875%, and allows local governments to collect a local option sales tax of up to 7.125%. Web this page covers the most important aspects of new. What Is The Vehicle Sales Tax In New Mexico.

From privateauto.com

How Much are Used Car Sales Taxes in Nebraska? What Is The Vehicle Sales Tax In New Mexico Web learn about the excise tax and fees for registering and transferring vehicles in new mexico. Web motor vehicle taxes & fees. New mexico local governments, researchers, policy makers and other individuals wanting. Web 356 rows new mexico has state sales tax of 4.875%, and allows local governments to collect a local option sales tax of up to 7.125%. Web. What Is The Vehicle Sales Tax In New Mexico.

From www.salestaxsolutions.us

Sales Tax New Mexico File New Mexico Sales Tax Online What Is The Vehicle Sales Tax In New Mexico Web motor vehicle taxes & fees. Web this page covers the most important aspects of new mexico's sales tax with respects to vehicle purchases. New mexico local governments, researchers, policy makers and other individuals wanting. Web learn about the 4% tax on the sale of every motor vehicle registered in new mexico, and how to apply for a title and.. What Is The Vehicle Sales Tax In New Mexico.

From exohpwnev.blob.core.windows.net

New Mexico Sales Tax Rules at Hector Iverson blog What Is The Vehicle Sales Tax In New Mexico Web learn about the excise tax and fees for registering and transferring vehicles in new mexico. New mexico local governments, researchers, policy makers and other individuals wanting. Web this page covers the most important aspects of new mexico's sales tax with respects to vehicle purchases. Web you can use our new mexico sales tax calculator to look up sales tax. What Is The Vehicle Sales Tax In New Mexico.

From edythelarose.blogspot.com

new mexico gross receipts tax return Edythe Larose What Is The Vehicle Sales Tax In New Mexico Web learn about the 4% tax on the sale of every motor vehicle registered in new mexico, and how to apply for a title and. Web motor vehicle taxes & fees. Web you can use our new mexico sales tax calculator to look up sales tax rates in new mexico by address / zip code. New mexico local governments, researchers,. What Is The Vehicle Sales Tax In New Mexico.

From 1stopvat.com

New Mexico Sales Tax Sales Tax New Mexico NM Sales Tax Rate What Is The Vehicle Sales Tax In New Mexico Web learn about the excise tax and fees for registering and transferring vehicles in new mexico. Web motor vehicle taxes & fees. Web you can use our new mexico sales tax calculator to look up sales tax rates in new mexico by address / zip code. Web learn about the 4% tax on the sale of every motor vehicle registered. What Is The Vehicle Sales Tax In New Mexico.

From sherrillbozeman.blogspot.com

kansas automobile sales tax calculator Sherrill Bozeman What Is The Vehicle Sales Tax In New Mexico Web you can use our new mexico sales tax calculator to look up sales tax rates in new mexico by address / zip code. Web 356 rows new mexico has state sales tax of 4.875%, and allows local governments to collect a local option sales tax of up to 7.125%. Web this page covers the most important aspects of new. What Is The Vehicle Sales Tax In New Mexico.

From leticiawjoye.pages.dev

New Mexico State Sales Tax Rate 2024 Taryn What Is The Vehicle Sales Tax In New Mexico Web this page covers the most important aspects of new mexico's sales tax with respects to vehicle purchases. Web you can use our new mexico sales tax calculator to look up sales tax rates in new mexico by address / zip code. Web the motor vehicle excise tax applies to the sale of every motor vehicle that must be registered. What Is The Vehicle Sales Tax In New Mexico.

From blog.accountingprose.com

New Mexico Sales Tax Guide What Is The Vehicle Sales Tax In New Mexico Web 356 rows new mexico has state sales tax of 4.875%, and allows local governments to collect a local option sales tax of up to 7.125%. Web the motor vehicle excise tax applies to the sale of every motor vehicle that must be registered in the state of. Web this page covers the most important aspects of new mexico's sales. What Is The Vehicle Sales Tax In New Mexico.

From vimcar.co.uk

HMRC Company Car Tax Rates 2020/21 Explained What Is The Vehicle Sales Tax In New Mexico Web the motor vehicle excise tax applies to the sale of every motor vehicle that must be registered in the state of. Web you can use our new mexico sales tax calculator to look up sales tax rates in new mexico by address / zip code. Web this page covers the most important aspects of new mexico's sales tax with. What Is The Vehicle Sales Tax In New Mexico.

From exormylib.blob.core.windows.net

Broomfield Car Sales Tax at Esther Flores blog What Is The Vehicle Sales Tax In New Mexico Web you can use our new mexico sales tax calculator to look up sales tax rates in new mexico by address / zip code. New mexico local governments, researchers, policy makers and other individuals wanting. Web motor vehicle taxes & fees. Web 356 rows new mexico has state sales tax of 4.875%, and allows local governments to collect a local. What Is The Vehicle Sales Tax In New Mexico.

From privateauto.com

How Much are Used Car Sales Taxes in Indiana? What Is The Vehicle Sales Tax In New Mexico Web you can use our new mexico sales tax calculator to look up sales tax rates in new mexico by address / zip code. Web learn about the excise tax and fees for registering and transferring vehicles in new mexico. Web the motor vehicle excise tax applies to the sale of every motor vehicle that must be registered in the. What Is The Vehicle Sales Tax In New Mexico.

From stepbystepbusiness.com

New Mexico Sales Tax Calculator What Is The Vehicle Sales Tax In New Mexico Web learn about the 4% tax on the sale of every motor vehicle registered in new mexico, and how to apply for a title and. Web 356 rows new mexico has state sales tax of 4.875%, and allows local governments to collect a local option sales tax of up to 7.125%. Web the motor vehicle excise tax applies to the. What Is The Vehicle Sales Tax In New Mexico.

From www.lendingtree.com

Is Buying a Car Tax Deductible? LendingTree What Is The Vehicle Sales Tax In New Mexico Web learn about the excise tax and fees for registering and transferring vehicles in new mexico. Web motor vehicle taxes & fees. Web 356 rows new mexico has state sales tax of 4.875%, and allows local governments to collect a local option sales tax of up to 7.125%. Web the motor vehicle excise tax applies to the sale of every. What Is The Vehicle Sales Tax In New Mexico.